2021.07.08Cash Flow Statement CFS Definition, Calculation, & Example

Contents:

There are several methods used to analyze a company’s cash flow, including the debt service coverage ratio, free cash flow, and unlevered cash flow. Cash received signifies inflows, and cash spent signifies outflows. As businesses generate cash, they can develop additional strategies by partnering or acquiring other companies to increase cash inflow further. We are working to improve access to information on beneficial owners for public authorities and strengthen the exchange of tax information.

IFFs are inherently difficult to measure, given the illegality of the flows and their underlying activities. “Money illegally earned, transferred, or used that crosses borders” is the most common definition of illicit financial flows . With a commitment to leading the way in efforts to curtail illicit financial flows and enhance global development and security. Many countries and their institutions actively facilitate—and reap enormous profits from—the theft of massive amounts of money from developing countries. GFI believes developed countries have a responsibility alongside developing countries to curtail the flow of illicit money.

Cash flow vs. profit

Although the company may incur liabilities, any payments toward these liabilities are not recorded as a cash outflow until the transaction occurs. The cash flow statement is a financial statement that reports on a company’s sources and usage of cash over some time. However, if the negative cash flow is occurring because the business is investing in different areas to bolster the long-term health of the business, then negative cash flow may not be a sign of trouble. This article will take you through a definition of what cash flow is and what types of cash flow businesses should be looking at.

Cogeco Inc. (CCA) Q2 2023 Earnings Call Transcript – AlphaStreet

Cogeco Inc. (CCA) Q2 2023 Earnings Call Transcript.

Posted: Fri, 14 Apr 2023 22:39:03 GMT [source]

The opening balance is the total amount of cash in your business accounts. As a result, if you are trying to prepare a cash flow statement, you will need to follow the below steps. Accounts receivable and accounts payable must also follow up swiftly on late payments and reassess any underperforming contracts. Rather than paying for large purchases outright, a business can also rely on a line of credit. Financing large orders through lenders, especially with a low-interest rate, can help leverage cash flow.

How to Read & Understand a Cash Flow Statement

It allows you to determine the rate of return or value of a project. Liquidity also refers to a business’ assets that we can easily convert into cash. Do not confuse the term with ‘cash.’ Cash isthe most liquid assets there is. For example, we classify coins, notes, traveler’s checks, short-term bank deposits, and other negotiable instruments as cash. NerdWallet strives to keep its information accurate and up to date.

Every company that sells and offers its stock to the public must file financial reports and statements with the U.S. Cash flow from financing is the final section, which provides an overview of cash used from debt and equity. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

How is cash flow represented in financial statements?

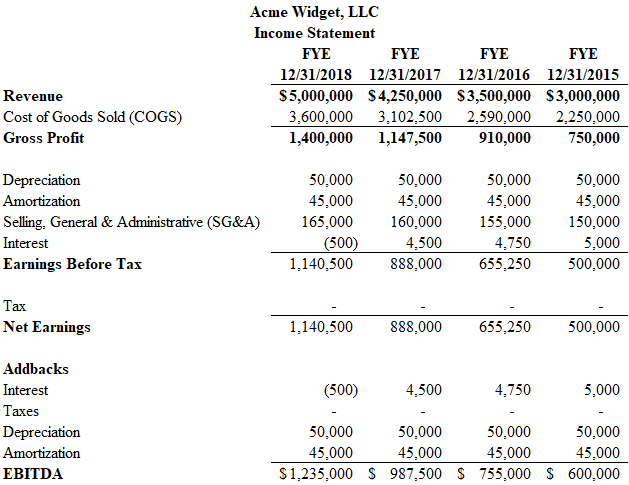

The table above shows an example of what a business’s cash flow statement looks like. Note that March is the actual month, and April is the month forecast. A typical cash flow statement has three sections that you need to keep in mind. This information allows businesses to forecast future cash needs, make informed investment decisions, and track actual performance against budgeted targets. Other companies may also have a higher capital investment which means they have more cash outflow rather than cash inflow.

Brookdale Provides Favorable Preliminary View on First Quarter … – StreetInsider.com

Brookdale Provides Favorable Preliminary View on First Quarter ….

Posted: Mon, 10 Apr 2023 20:19:21 GMT [source]

As a result, if you focus on only one of these metrics, you will miss out on the whole picture of how your company is operating. Cash flow per share refers to the after-tax earnings, including depreciation on a per-share basis, that measure the firm’s financial strength. This figure is calculated by taking the cash from operating activities and dividing it by the number of outstanding shares.

Financial documents are designed to provide insight into the financial health and status of an organization. If you’re an investor, this information can help you better understand whether you should invest in a company. If you’re a business owner or entrepreneur, it can help you understand business performance and adjust key initiatives or strategies.

According to its income statement, a company may show the most fantastic performance backed by huge profits. The indirect method uses changes in balance sheet accounts to modify the operating section of the cash flow statement from the accrual method to the cash method. It looks at cash flows from investing and is the result of investment gains and losses.

Cash inflow and outflow

For example, if there are outstanding invoices, but you have to pay your bills on time, you will have a cash flow problem. However, you will be fine for a while if you have an emergency fund. This value is the total of all payments made, including rent, salaries, inventory, taxes and loan payments. Annual bills should be counted in the month they’re paid, even if your business spreads the budget over the year. Cash flow is a measurement of the money moving in and out of a business, and it helps to determine financial health. Cash flow from operating activities can be calculated by using either the direct or indirect method.

- Analysis includes looking for trends, areas of strong performance, cash flow problems, and opportunities for improvement.

- Understanding cash sources and where your cash is going is essential for maintaining a financially sustainable business.

- It would also be helpful to know how they interact with each other and what the terms can mean for your business.

- An arrow diagram, showing the flows in and out of the pool of corporate cash, has also been developed.

Cash flow refers to the money that comes into the business, as well as the money that leaves the business. That is to say, it records and calculates all the money circulating within the company. Figures used in this method are presented in a straightforward manner. They can be calculated using the beginning and ending balances of various asset and liability accounts and assessing their net decrease or increase. Together, these different sections can help investors and analysts determine the value of a company as a whole. It produces what is called the net cash flow by breaking down where the changes in the beginning and ending balances came from.

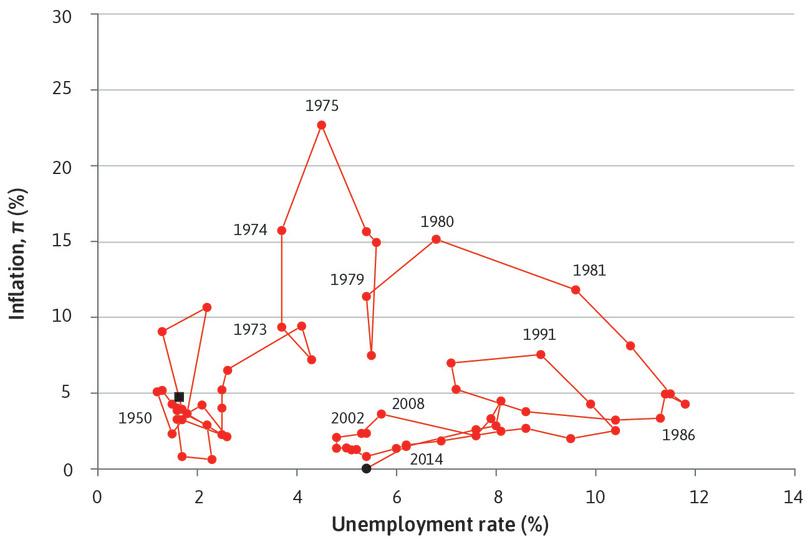

Cash flow analysis is a review of business cash flows with a goal of finding trends or opportunities that allow for improved business decisions and improved long-term growth and sustainability. Cash flow analysis is a method of reviewing cash flow details for a business. An example may be as simple as looking at the latest cash flow statement or require more complex calculations, ratios, and comparisons. Cash flow analysis helps your finance team better manage cash inflow and cash outflow, ensuring that there will be enough money to run—and grow—the business. Cash flow analysis helps you understand how much cash a business generated or used during a specific accounting period.

The recent 11% gain must have brightened CEO Konrad Weiske’s week, Spyrosoft Spólka Akcyjna’s (WSE:SPR) most bullish insider – Simply Wall St

The recent 11% gain must have brightened CEO Konrad Weiske’s week, Spyrosoft Spólka Akcyjna’s (WSE:SPR) most bullish insider.

Posted: Sat, 15 Apr 2023 06:57:11 GMT [source]

This is a https://1investing.in/‘s cash flow excluding interest payments, and it shows how much cash is available to the firm before taking financial obligations into account. The difference between levered and unlevered FCF shows if the business is overextended or operating with a healthy amount of debt. Companies with strong financial flexibility can take advantage of profitable investments. They also fare better in downturns, by avoiding the costs of financial distress.

Resolves the other two what is bookkeepings by showing whether revenues have been collected and expenses paid. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. In truth, whether you are a business owner or an investor, you should have a good understanding of both terms and what they mean. It would also be helpful to know how they interact with each other and what the terms can mean for your business. Although both methods will have the same result, the process of calculating each will differ.

It’s a helpful tool, but it’s important to consider the cash flow statement alongside your income statement and balance sheet to ensure your business is thriving. Financing cash flow refers to how cash moves between investors, owners, creditors and a business. Basically, it is the cash that is generated to finance the company and includes the costs of raising capital, dividend payments and debt. The statement of cash flows is used to assess the cash flows of a business. Smaller organizations may not release a statement of cash flows on a monthly basis, since some additional effort is required to create it.

Contrary to what you may think, cash flow isn’t the same as profit. It isn’t uncommon to have these two terms confused because they seem very similar. Remember that cash flow is the money that goes in and out of a business. Cash flow can be negative when outflows are higher than a company’s inflows.

NEWSLIST